The forex market has been growing at a rapid pace in Bolivia, where increased currency stability, free-floating government regulations and an expanded internet infrastructure has made it easier to trade. If you’ve ever wanted to trade forex in Bolivia, our comprehensive guide will show you how to get started, open a brokerage account and formulate your own unique trading strategy.

Get Started with Forex in Bolivia

Getting started with forex trading begins with opening a brokerage account. You can open a brokerage account on nearly any device that connects to the internet, including:

- Desktop computers

- Mobile phones

- Tablets

- Laptops

Before you begin the process of opening an account, check and make sure that your internet connection is secure and private. You may also want to run a speed test on your device.

There are many international and local brokers offering forex trading capabilities to investors in Bolivia. When you compare brokers, be sure to consider the following characteristics:

- Currencies the broker offers access to

- Territories the broker services

- Local and international licensure and regulation status

- Account minimums

- Fees and other transaction expenses

When you find a broker that you want to work with, create an account using that broker’s process. You may also need to download a 3rd-party trading platform like MetaTrader 4 or 5 before you can trade.

After your account has been opened in full, choose how you’d like to deposit trading funds. Most brokers in Bolivia allow you to fund your account using a number of methods, including:

- Direct bank transfers

- Transfers from electronic wallets like PayPal or Skrill

- Deposits from a debit or credit card

It might take a few days for your deposit to show in your account. When your deposit clears, you can officially trade forex by placing your first order through your broker.

Bolivia Forex Trading Strategies

Thanks to a high level of volatility, most forex traders in Bolivia use a technical analysis strategy to profit from their trades. Technical analysis is a type of currency examination that uses past charting patterns and indicators to predict how the price of the currency will move in the future. There are a wide range of technical analysis strategies used throughout the world. Let’s take a look at a few examples to help you get started.

Head and Shoulders

The head and shoulders pattern is 1 of the most commonly used technical analysis formations. The head and shoulders pattern first establishes a baseline, with 2 minor peaks positioned in between a major peak. This pattern gets its name from its shape, which resembles a head and a pair of shoulders. The head and shoulders pattern is a bearish indicator and typically represents a sell signal.

Reversal Candlesticks

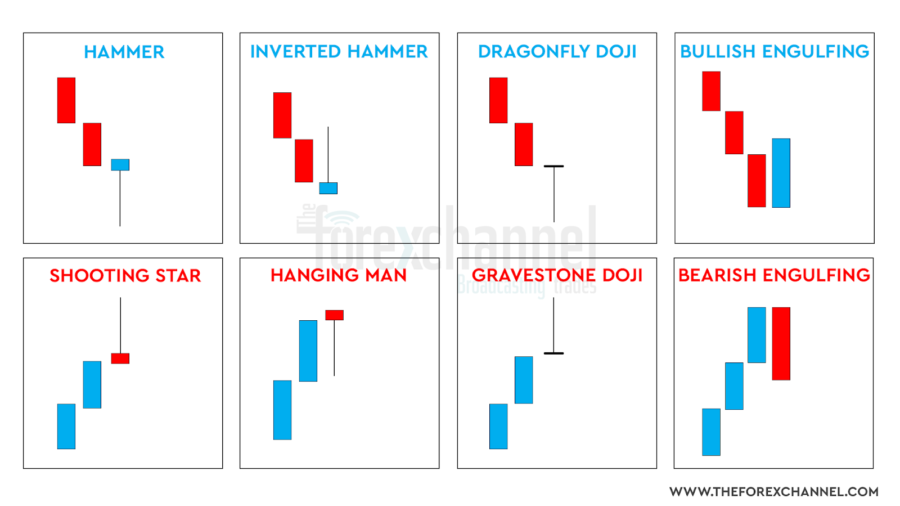

Traders who rely on short-term price movements often use reversal candlesticks to determine when they should buy or sell a currency. A reversal candlestick is an indicator that signifies that a currency’s price trend direction will change soon. A reversal candlestick can be bullish or bearish depending on its position. There are a wide range of reversal candlesticks, and the strength of each candlestick is typically determined by its tail length.

Forex Trading Example in Bolivia

How can you earn money trading forex? Let’s take a look at an example of how differences in currency values can be profitable for you.

Imagine that you fund your account with Bs10,000. Your broker offers you 10:1 leverage, which means that you can place trades worth up to Bs100,000. You believe that the value of the USD will rise in relation to the BOB, so you use your entire lot and leverage to buy dollars. $1 is currently equal to 6.89 BOB — converting Bs100,000 leaves you with about $14,513.79.

Soon, you see that the value of the BOB is falling in comparison to the U.S. dollar. When $1 is equal to 6.93 BOB, you decide to cash out. You convert your entire lot of dollars back to BOB and receive Bs100,580.55 in the trade. This means that, after accounting for leverage and your initial deposit, you’ve earned a profit of about Bs580.55.

Making Money with Forex in Bolivia

Though the realm of forex trading is still gaining traction in Bolivia, residents and travelers in Bolivia are free to exchange currencies as they wish. There are no limitations on the amount of money that you can deposit into an international brokerage account. You don’t need any type of special permissions from the Central Bank of Bolivia before you begin.

This freedom to trade combined with a growing internet infrastructure has led to the growth of forex trading in Bolivia. However, you’ll need to take steps to protect yourself and your capital during this period of change and growth. Some of the ways you can fight back against fraud and forex scams include:

- Working only with licensed, well-known brokers. Whether they’re registered with the Central Bank of Bolivia or a comparable international oversight body, legitimate forex brokers are always regulated. Be sure to ask about licensure and regulation before you open an account.

- Limit your leverage usage. It’s possible to find local brokers offering up to 1,000:1 leverage. This is a dangerously high level of leverage that’s very likely to cause bankruptcy for new traders. Limit the amount of leverage you use as much as possible.

- Practice trading with a demo account. Most forex brokers allow you to practice your trading strategy with a demo account before investing your own money. Be sure to get familiar with your broker’s tools before you invest.

Best Online Forex Brokers in Bolivia

The forex broker you choose will dictate how much you pay in fees, which currencies you can buy and sell, the platforms you can use to trade and more. This means that it’s well worth the effort to take plenty of time researching and comparing brokers before you open an account.

Don’t have time to conduct your own research? Consider opening an account with one of our favorite international brokers offering services to investors in Bolivia below.

Forex Terminology

One of the first things that you’ll notice when you begin researching the forex market is that forex traders seem to have their own unique language they use when discussing trades. Familiarizing yourself with forex terminology before you enter the market can enhance your understanding of the materials you’re reading. Explore a few of the most common forex terms you’ll hear with the definitions below.

- Pip: A single pip is the smallest calculatable unit by which a currency can move, usually calculated to the 4th decimal place. For example, if a currency moves from a value of $1.0000 to $1.0010, you could say that the value increased by 10 pips.

- Lot size: Your lot size is equal to the number of units of currency you are buying or selling on a single trade. For example, if you want to exchange ¥100,000 into euros, your lot size is equal to 100,000. Most forex traders consider 100,000 units of currency to be a “standard lot.”

- Orders: An order is a specific set of instructions you provide to your forex broker so they can carry out a trade on your behalf. When you place an order, you’ll specify which currencies you’re exchanging, your lot size, the price that you need the order executed at and more. There are multiple types of orders and you can combine order types to limit your loss and automatically take profits.

- Calls: A margin call is a risk of using leverage to trade. If you borrow money on leverage and your portfolio falls below a certain percentage, your broker might subject you to a margin call. If you receive a margin call, you’ll need to deposit more money in your account to make up the difference. If you cannot bring your portfolio value back up, you’ll need to exit your positions.

Getting Started with Forex Trading

Forex trading is still a relatively new market for traders and investors in Bolivia. This means that laws and restrictions on brokers, leverage caps and more may change in the coming years as the Bolivian government gains a fuller understanding of how currency investing affects the local economy. If you do decide to trade forex, be sure to protect yourself and your investment by only using licensed brokers to invest with, limiting your leverage usage and practicing your trading on a demo account before you put money into your broker’s account.

https://www.benzinga.com/money/forex-trading-in-bolivia/

2020-07-22 22:01:00Z

CBMiOGh0dHBzOi8vd3d3LmJlbnppbmdhLmNvbS9tb25leS9mb3JleC10cmFkaW5nLWluLWJvbGl2aWEv0gEA

Bagikan Berita Ini

0 Response to "Forex Trading in Bolivia • Forex Strategy • Benzinga - Benzinga"

Post a Comment