Good morning, traders.

Last week, the US stocks fell further after news reports that Chinese trade officials cut short their trip to the US. The Dow Jones Industrial Average DOW drove 159 points (-0.6%) to 26935, the S&P 500 SPX shifted 14 points (-0.5%) to 2992, and the Nasdaq Composite was down 65 points (-0.8%) to 8117. The stock market indicated the sign of a drop in the risk appetite, which later resulted in the surge of gold prices.

The Eurozone seems to suffer again as almost all of the economic events from the Eurozone has missed the forecasts. The Eurozone economy came close to stalling at the end of the third quarter as demand for goods and services fell at the fastest rate in over six years. Let’s take a more in-depth look into the Eurozone’s economic events.

Watchlist – Economic Events Outlook

The Eurozone’s economic events have already been released but during the early European session and now most of the focus shifts to the ECB, and Fed FOMC speeches later in the day.

EUR – French Flash Services PMI

The Markit Flash Services PMI for France fell from 52.9 in August to 51.3 in September. It’s led to the weakest development in private sector activity for four months.

The steady extension was supported by a surge of activity in the service area. That stated, the rate of growth reported by service providers fell to the slowest since May, which is driving a sharp bearish trend in EUR/USD and Euro related pairs.

EUR – French Flash Manufacturing PMI

On the other hand, French Flash Manufacturing PMI also slipped to 50.3 vs. the forecast of 50.9, driving further bears for EUR/USD.

EUR – German Flash Manufacturing PMI

As per the latest flash PMI figure, the German market declined in September over the downturn in manufacturing and services sector.

The Markit Flash Germany Composite Output Index – which is based on approximately 85% of usual monthly returns – recorded 49.1 in September, falling from 51.7 in August. It’s giving investors another reason to open sell positions in the EUR/USD. Well, it helped us secure quick profits in EUR/JPY today.

GBP – MPC Member Tenreyro Speaks – 9:15 GMT

The Bank of England MPC member Silvana Tenreyro is due to speak at the European Central Bank Conference, in Frankfurt. Audience questions are expected which makes this event a highlighted one. The audience may ask for further clues on the BOE interest rates and its policy to deal with the falling inflation rates.

EUR – German Buba Monthly Report – 10:00 GMT

The report contains relevant articles, speeches, statistical tables, and provides a detailed analysis of current and future economic conditions from the bank’s viewpoint.

The Bundesbank is due to release to report at 10:00 GMT, but the report tends to have a muted impact as all the information has already been known to investors. However, the market impact tends to be higher when the report reveals a viewpoint that clashes with the ECB’s stance.

EUR – ECB President Draghi Speaks

The European Central Bank President is due to testify about the economy and monetary policy before the European Parliament Economic and Monetary Affairs Committee, in Brussels.

As head of the ECB, which controls short term interest rates, he has more influence over the Euro’s value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

Investors will be looking for forward guidance on the ECB’s next policy meeting and decisions. The Euro may have a muted impact on the speech as most of the ECB plans are already known and “priced in”.

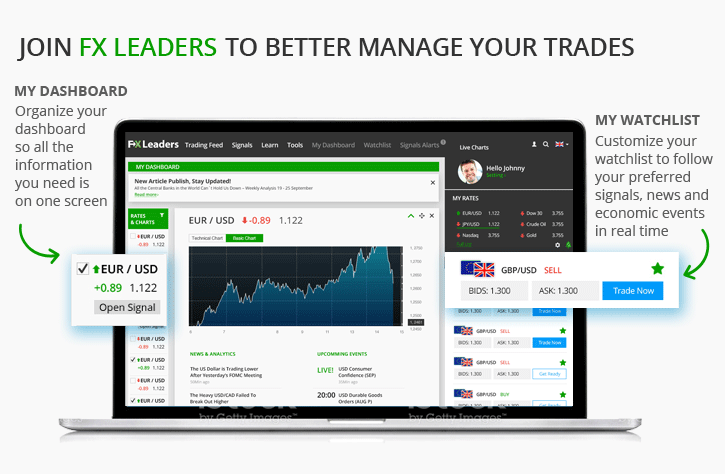

Good luck, fellas. Stay tuned to FX Leaders for technical trade setups and forex trading signals!

Related Articles

https://www.fxleaders.com/news/2019/09/23/daily-brief-sep-23-economic-events-outlook-eurozones-events-in-highlights/

2019-09-23 08:39:05Z

52780391372231

Bagikan Berita Ini

0 Response to "Daily Brief, Sep 23: Economic Events Outlook - Eurozone's Events in Highlights - FX Leaders"

Post a Comment