The US dollar index (DXY) climbed for the fourth straight session, hitting a fresh high of 99.65 after further hawkish remarks by Federal Reserve (the Fed) officials on the need to accelerate balance-sheet reduction.

Fed governor Lael Brainard stated that the Fed would continue to tighten policy methodically since containing inflation is the central bank’s top goal now, adding that the balance-sheet reduction will occur begin as early as May and move quickly.

Yesterday, the Treasury market was jolted as investors began to discount a faster-than-expected pace of the forced buyer’s exit. As a result, US Treasury yields skyrocketed, with the 10-year yield exceeding the 2.6% mark, currently at its highest level since March 2019.

Meanwhile, the real rate on 10-year Treasury inflation-protected securities has risen to -0.17% – the highest since March 2020 – reflecting the Fed’s monetary policy shift.

Earlier this morning, the EUR/USD pair dipped below the 1.09 level for the first time since March 8 before regaining ground around the 1.091–1.092 range at the time of writing.

US dollar index (DXY) hits May 2020 highs amid hawkish Fed

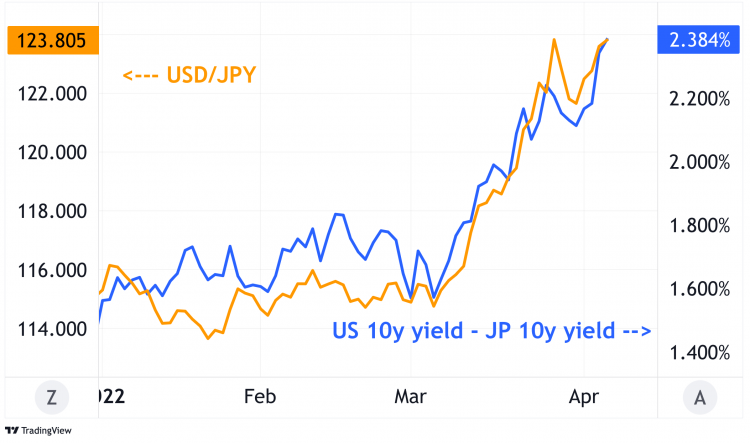

The Japanese yen (JPY) was once again yesterday’s worst performer, gripped by rising Treasury yields and widening monetary divergences between the US Federal Reserve and the Bank of Japan (BoJ – see chart below).

Commodity-linked currencies, such as the Australian dollar (AUD), which had been gaining ground in recent weeks, had a little pullback overnight following the data on Chinese service activity, which fell much below expectations (42 versus 49.7) in March.

This has indicated a worsening in business sentiment after the sharp increase in Covid-19 infections.

On the geopolitical front, the US, EU and G7 are coordinating a new round of sanctions on Russia. The US is considering a restriction on investments in Russia, while the EU has declared an embargo on Russian coal imports, as well as a discussion about targeting Russian oil.

What is your sentiment on AUD/USD?

Bullish

orBearish

Vote to see Traders sentiment!

NATO’s foreign ministers will meet this afternoon in Brussels to discuss the Russian invasion of Ukraine. The Fed will also release the minutes from the most recent Federal Open Market Committee (FOMC) meeting, which are likely to provide details about its intentions regarding its strategy to reduce its balance sheet.

Following yesterday’s price action, the market’s risk sentiment continues to walk on thin ice, and today might be another day of volatility.

Chart of the day: USD/JPY is all about a rate-divergence story

USD/JPY versus US-Japan 10-year yield spread – Credit: Capital.com / Source: Tradingview

USD/JPY versus US-Japan 10-year yield spread – Credit: Capital.com / Source: TradingviewForex markets today – 6 April 2022

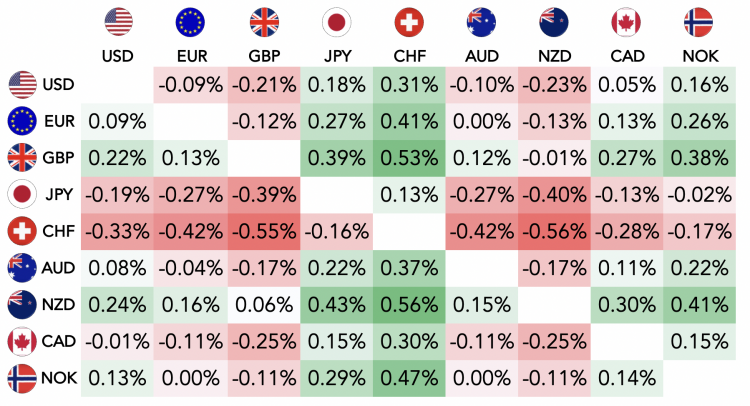

- In London’s morning trade, the US Dollar Index (DXY) traded at 99.40, unchanged on the day after gaining 0.5% yesterday.

- The euro (EUR) hovered around $1.091, up 0.1% on the day after weakening by 0.6% yesterday. The British pound (GBP) gained 0.2% to $1.31 after falling by 0.3% yesterday.

- Low-yielding safe-haven currencies, such as the Japanese yen (JPY) and the Swiss franc (CHF), slipped by 0.2% and 0.4%, respectively amid rising US Treasury yields.

- Among oil-linked currencies, the Canadian dollar (CAD) held steady versus the USD, while the Norwegian krone (NOK) gained 0.2% amid prospects of increasing EU energy imports from Norway.

- The commodity-linked Australian dollar (AUD) paused for a breather after three sessions of gains against the USD. The New Zealand dollar (NZD) is up marginally by 0.2%.

- Among Central Eastern European (CEE), the Hungarian forint (HUF) continues to remain under pressure, slipping 0.8% versus the EUR today and after falling by 2% yesterday due to the higher political risk premium following Victor Orban’s victory in the elections.

The Czech koruna (CZK) slipped by 0.4% this morning against the euro, while the Polish zloty (PLN) was flat.

- Emerging market (EM) currencies were slightly changed, following yesterday's sell off. The South African rand (ZAR) edged 0.3% higher, after losing 0.6% yesterday. The Turkish lira (TRY) is mostly unchanged on the day.

In Asia, the Korean won (KRW) and the Chinese yuan (CNH) were both marginally lower (-0.1%). The Russian rouble (RUB) fell 2% amid risks of escalating sanctions. The Mexican peso (MXN) held steady this morning, after weakening by as much as 1% yesterday.

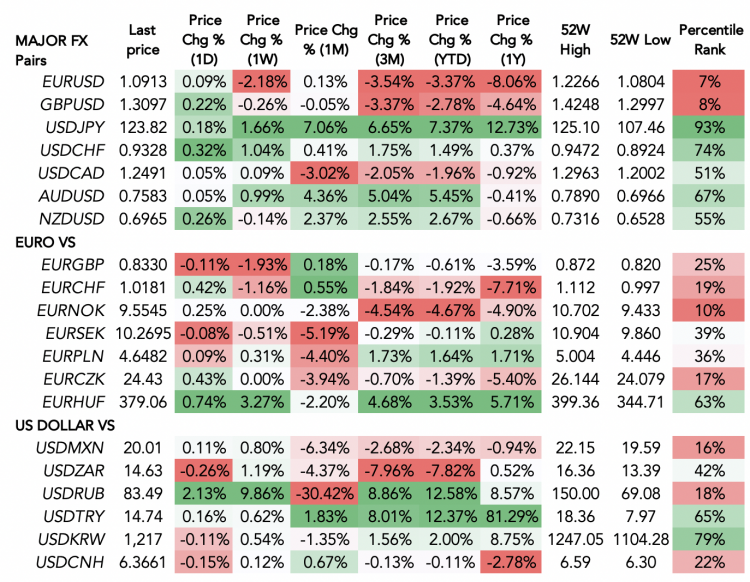

Major currencies: Top risers and fallers today – 6 April 2022

Major currencies: Today’s top risers and fallers, 6 April 2022, 11:00 UTC – Credit: Capital.com

Major currencies: Today’s top risers and fallers, 6 April 2022, 11:00 UTC – Credit: Capital.comForex market heatmap – 6 April 2022

Forex market heatmap as of 6 April 2022, 11:00 UTC – Credit: Capital.com

Forex market heatmap as of 6 April 2022, 11:00 UTC – Credit: Capital.comRead more

https://capital.com/forex-news-usd-hits-fresh-high-as-treasury-yields-skyrocket

2022-04-06 11:00:00Z

CBMiT2h0dHBzOi8vY2FwaXRhbC5jb20vZm9yZXgtbmV3cy11c2QtaGl0cy1mcmVzaC1oaWdoLWFzLXRyZWFzdXJ5LXlpZWxkcy1za3lyb2NrZXTSAVNodHRwczovL2NhcGl0YWwuY29tL2FtcC9mb3JleC1uZXdzLXVzZC1oaXRzLWZyZXNoLWhpZ2gtYXMtdHJlYXN1cnkteWllbGRzLXNreXJvY2tldA

Bagikan Berita Ini

0 Response to "Forex news: USD hits fresh high as Treasury yields skyrocket - Capital.com"

Post a Comment