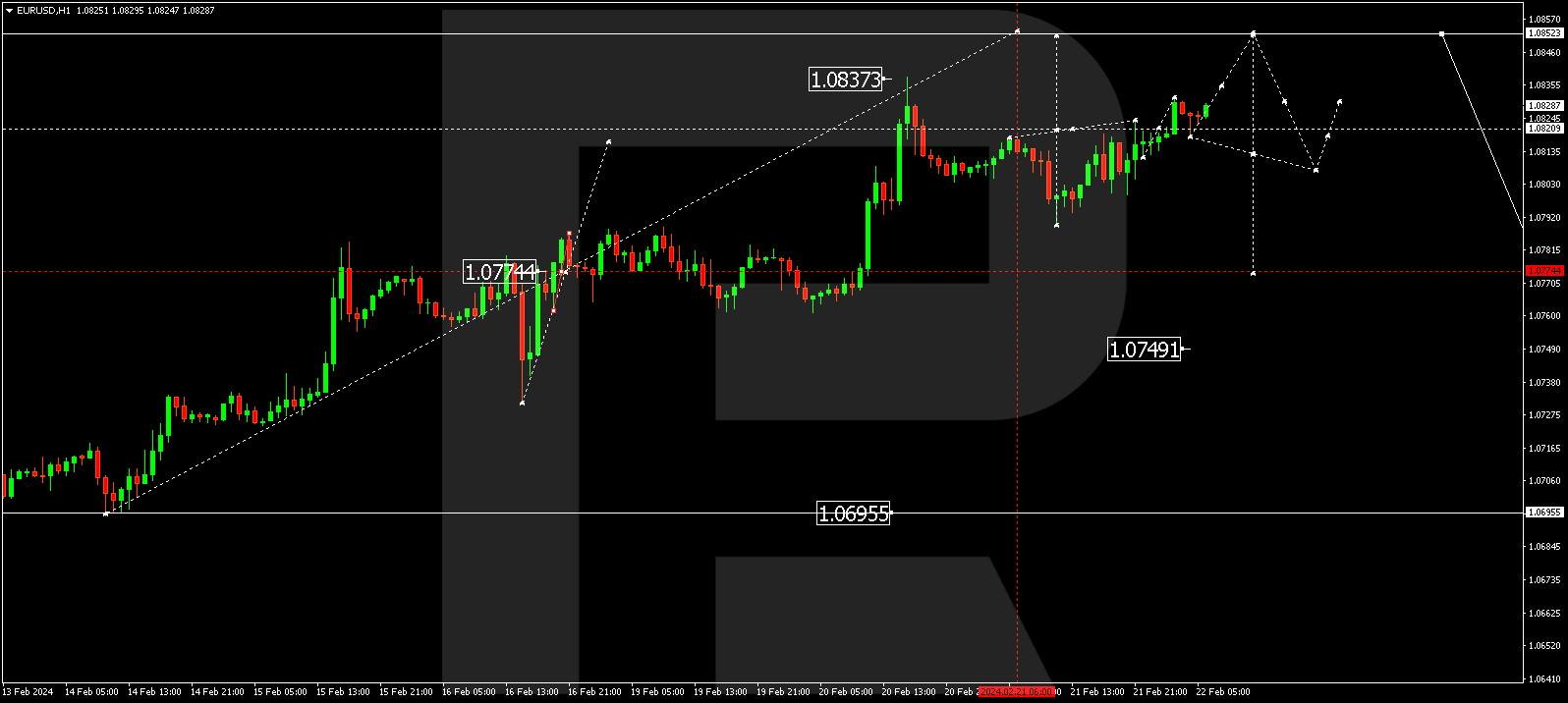

EUR/USD, “Euro vs US Dollar”

The EUR/USD pair completed a growth wave structure to the 1.0823 level. Today the market has formed a consolidation range around this level and, escaping it upwards, might extend the correction to 1.0852. Once it is over, a new decline wave to 1.0774 could begin.

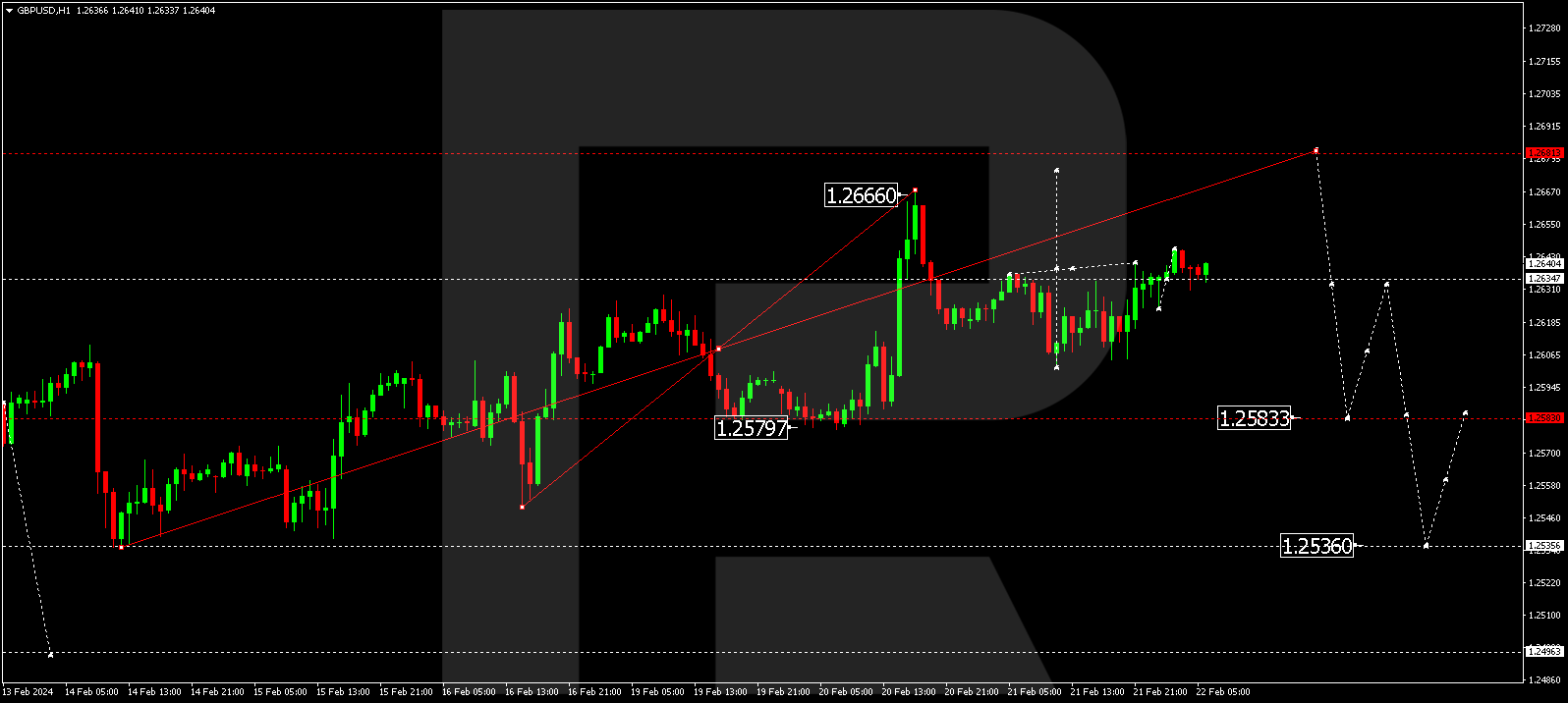

GBP/USD, “Great Britain Pound vs US Dollar”

The GBP/USD pair completed a growth wave to 1.2640. Today the market is forming a consolidation range around this level. With an escape upwards, the correction could extend to 1.2681. Once this corrective wave is over, a decline to 1.2583 might start. This is the first target.

USD/JPY, “US Dollar vs Japanese Yen”

The USD/JPY pair continues developing a consolidation range around the 150.04 level. By now, the market has extended the range to 150.45. Today a decline link to 149.55 is expected. Next, a growth link to 150.04 might follow (a test from below). After that, the quotes could drop to 149.37.

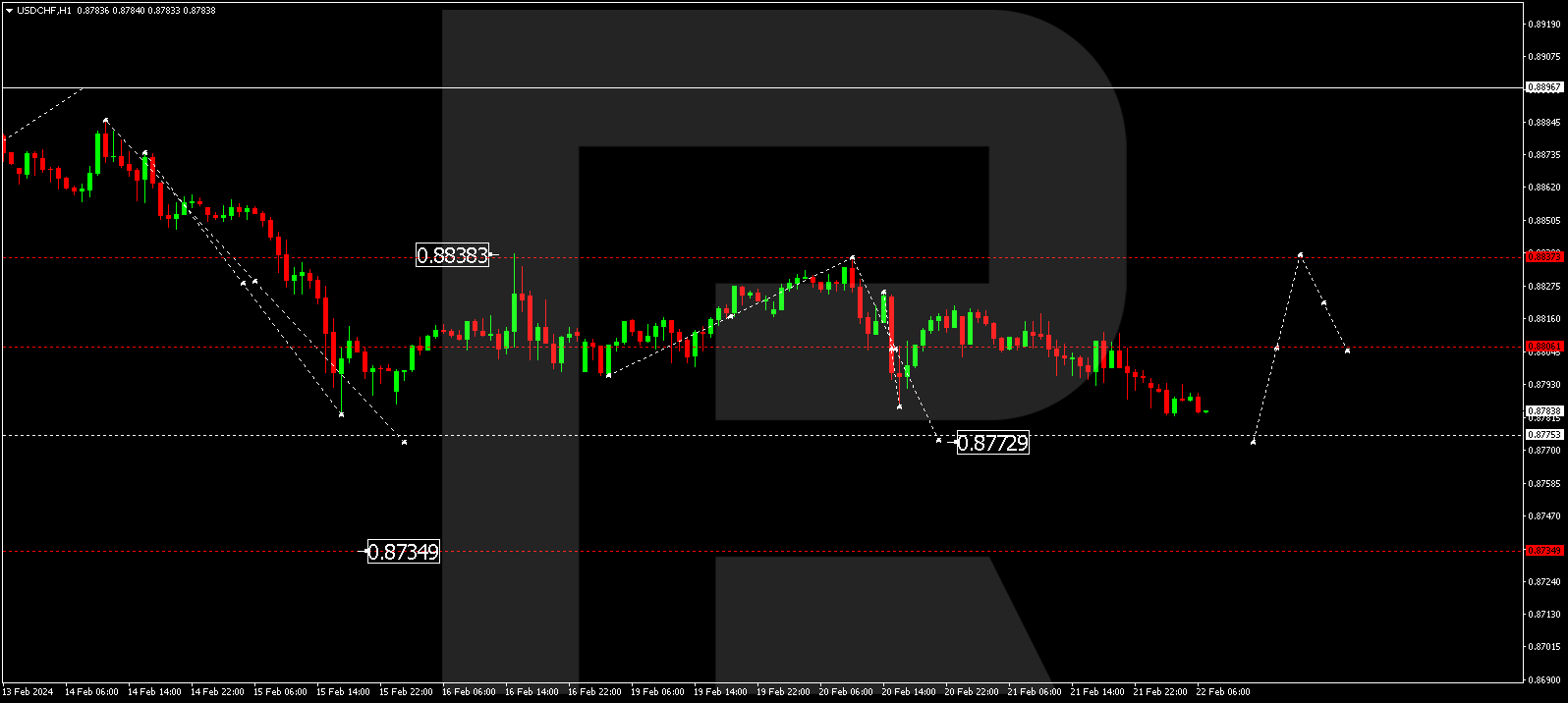

USD/CHF, “US Dollar vs Swiss Franc”

The USD/CHF pair continues falling to the 0.8775 level. Once this level is reached, a growth wave to 0.8837 might begin, followed by a decline to 0.8806. Practically, a wide consolidation range is expected to develop. With an escape from the range upwards, the trend could continue to 0.8898.

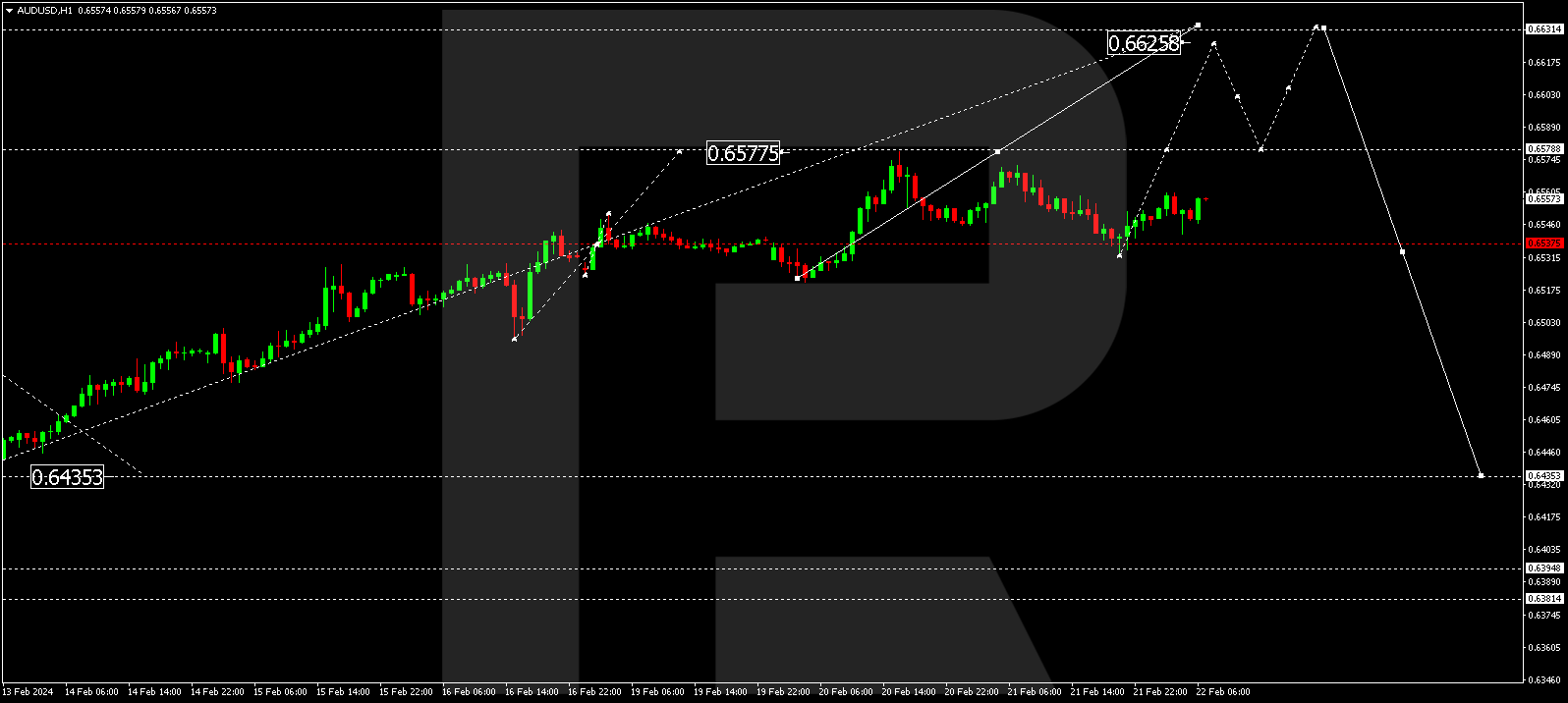

AUD/USD, “Australian Dollar vs US Dollar”

The AUD/USD pair continues forming a growth link to 0.6578. Next, a consolidation range might conclude. With an escape from the range upwards, the correction could extend to 0.6626. Once the correction is over, a decline wave to 0.6535 might start, from where the trend could continue to 0.6435.

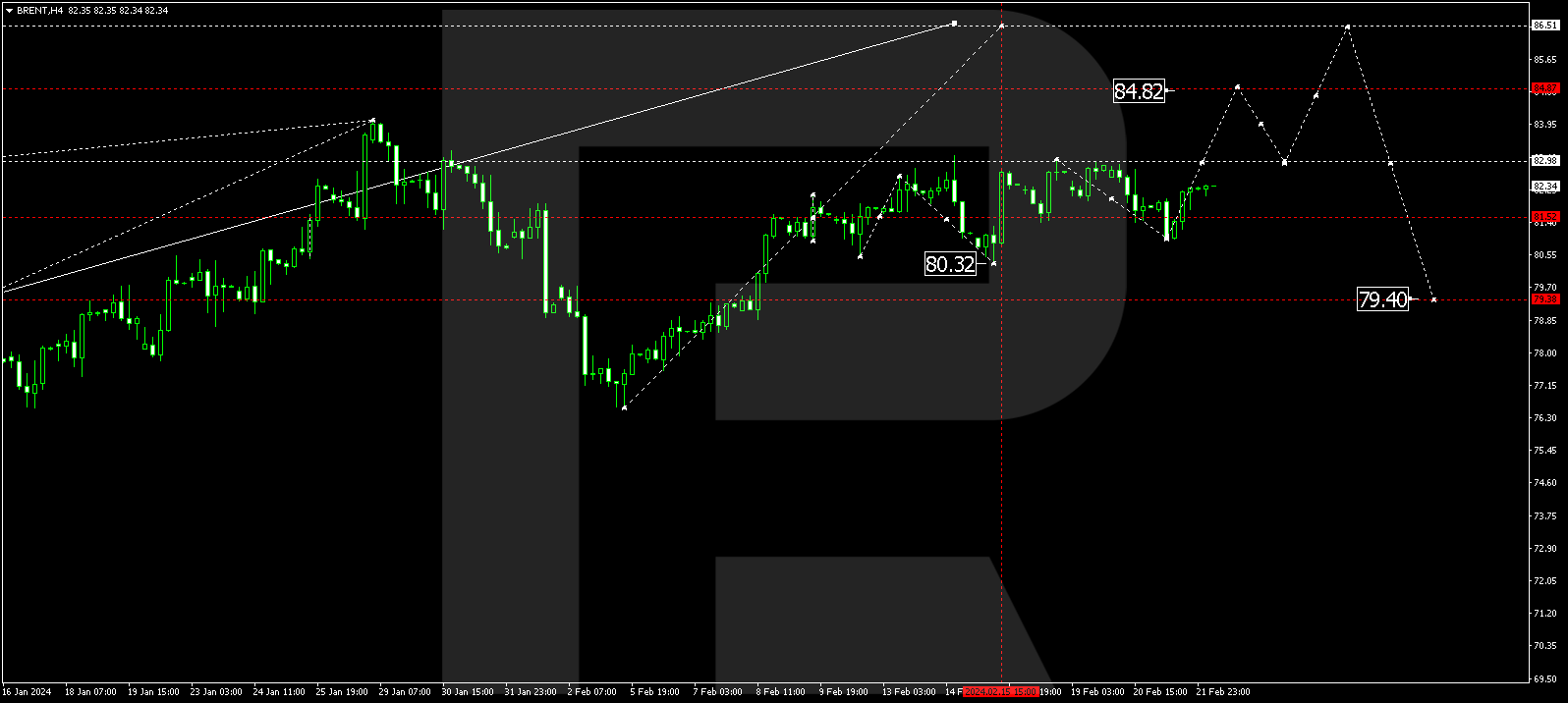

Brent

Brent continues developing a consolidation range around the 81.52 level without any obvious trend. A growth link to 82.98 is expected today. If this level also breaks upwards, the potential for a growth wave to 84.82 might open, and the trend could extend to 86.50. This is the first target.

XAU/USD, “Gold vs US Dollar”

Gold continues forming a consolidation range around 2026.34. Today the quotes could break the range upwards to 2036.66. Once this level is reached, a decline wave to 2010.80 might start. This is the first target.

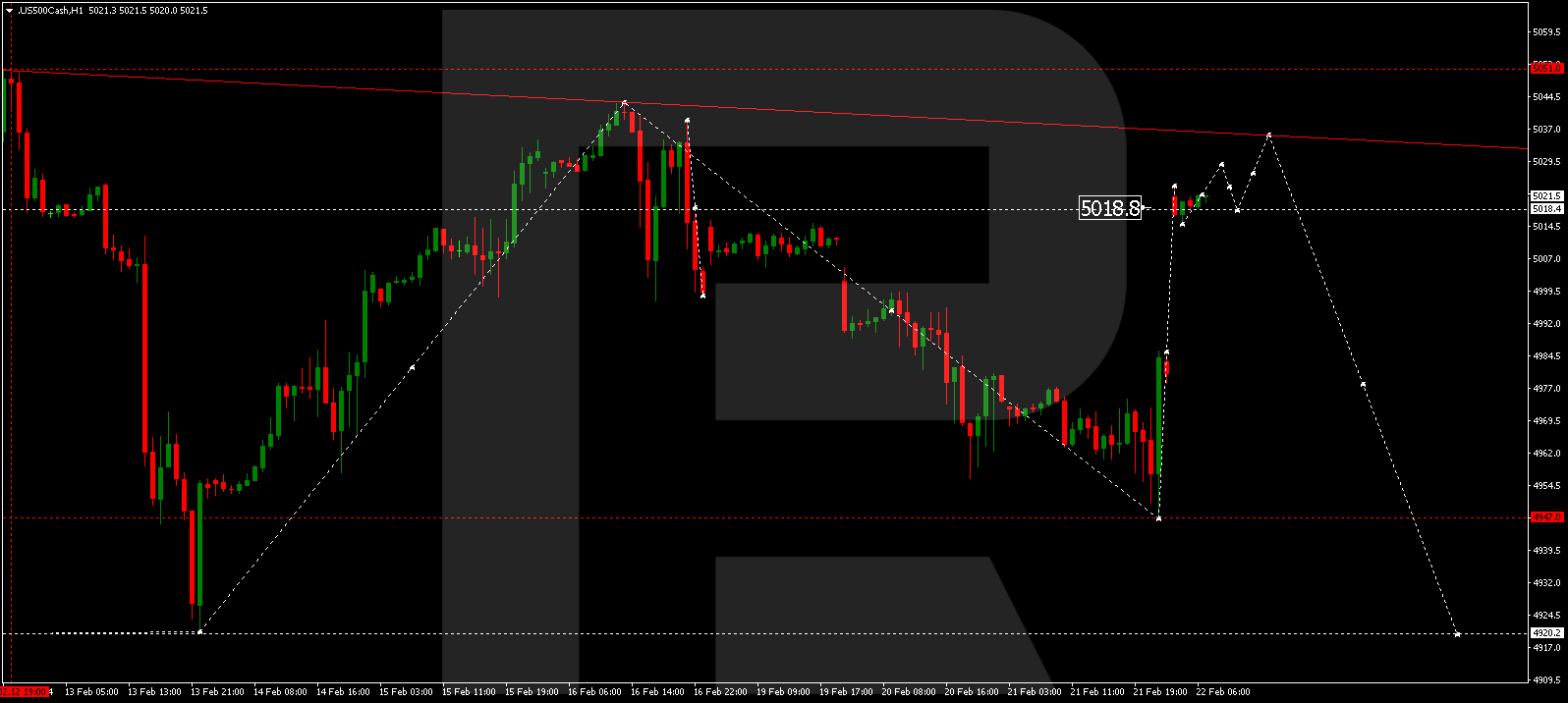

S&P 500

The stock index has completed a decline wave structure to 4947.0, concluding a growth impulse to 5018.0 today. Currently, a consolidation range is forming around this level. With an upward escape, a growth link to 5030.0 is expected. With an escape downwards, a decline to 4988.0 could follow. Practically, a wide consolidation range is expected to form at the top of the growth wave.

https://news.google.com/rss/articles/CBMidGh0dHBzOi8vd3d3LmZ4c3RyZWV0LmNvbS9hbmFseXNpcy9mb3JleC10ZWNobmljYWwtYW5hbHlzaXMtYW5kLWZvcmVjYXN0LW1ham9ycy1lcXVpdGllcy1hbmQtY29tbW9kaXRpZXMtMjAyNDAyMjIwODM00gF4aHR0cHM6Ly93d3cuZnhzdHJlZXQuY29tL2FtcC9hbmFseXNpcy9mb3JleC10ZWNobmljYWwtYW5hbHlzaXMtYW5kLWZvcmVjYXN0LW1ham9ycy1lcXVpdGllcy1hbmQtY29tbW9kaXRpZXMtMjAyNDAyMjIwODM0?oc=5

2024-02-22 08:34:02Z

CBMidGh0dHBzOi8vd3d3LmZ4c3RyZWV0LmNvbS9hbmFseXNpcy9mb3JleC10ZWNobmljYWwtYW5hbHlzaXMtYW5kLWZvcmVjYXN0LW1ham9ycy1lcXVpdGllcy1hbmQtY29tbW9kaXRpZXMtMjAyNDAyMjIwODM00gF4aHR0cHM6Ly93d3cuZnhzdHJlZXQuY29tL2FtcC9hbmFseXNpcy9mb3JleC10ZWNobmljYWwtYW5hbHlzaXMtYW5kLWZvcmVjYXN0LW1ham9ycy1lcXVpdGllcy1hbmQtY29tbW9kaXRpZXMtMjAyNDAyMjIwODM0

Bagikan Berita Ini

0 Response to "Forex technical analysis and forecast: Majors, equities and commodities - FXStreet"

Post a Comment